In 2025, the real estate industry in Dubai will still shine, drawing the attention of investors around the world to invest in this futuristic city with investor-friendly policies and tax benefits. With the emirate continuing its traditions of innovation and urban excellence, investment in property is a strategic step, whether a person is a long-time investor or a first-time buyer. Nevertheless, one important choice continues to split views on all sides: To invest in off-plan or ready properties?

This October at Prime Bullions, we take an in-depth look at one of the most debated topics in the active property market of Dubai: Off-Plan vs. Ready Properties. Each of these two options has its own benefits and pitfalls in regards to the objectives of an investor, his/her risk tolerance, and time frame.

Off-plan properties are those that are currently in the planning or construction phase.

Properties that are being constructed or planned are referred to as off-plan properties. They are the kinds of properties that the builders sell to investors prior to their completion and usually at a very affordable price compared to the ones which are for sale after their completion.

Conversely, ready properties are already finished and available for immediate occupancy or for rental purposes. These are usually the units sold by developers, individual sellers or brokers that allow the buyers to have a quick handover and generate rental income.

Now, let’s discover the positive and negative sides of each category in the Dubai 2025 real estate context.

Pros of Off-Plan Properties

1. Less Expensive Entrance and Greater Increase in the Investment.

The market starting price of off-plan investments is considered its most attractive feature. Developers, to lure initial investors, usually offer off-plan units at prices way below the market value. If the property in question has been located in growth areas such as Dubai Hills, JVC, and Business Bay, areas receiving HugoFS Investments’ top ratings, it is then expected that there will be a substantial price increase in real estate after the completion of the project.

2. Flexible Payment Plans

Developer-backed payment terms for off-plan properties are quite often accompanied by flexible year instalment plans. A good example is where the buyers can make down payments of only 10-20%, spread the rest over the construction period, and even sometimes after the handover.

3. Customization Options

Asking for customization options is also a possibility for those buying very early into the development of a project, and some of the options are related to the design, such as changes in the layout or the finishes that they prefer. This is particularly advantageous for investors who have a set vision for their brand or end-user that extends over a long period.

4. Newer Amenities and Sustainable Design

The off-plan projects in Dubai in 2025 will reflect the emirate’s smart city and sustainability vision. This will involve the use of green technology, smart appliances, community-centred planning, and the integration of futuristic infrastructure right from the blueprint phase.

The Cons of Off-Plan Properties

1. Completion Delays and Uncertainty

Delay or cancellation of the projects is perhaps the largest disadvantage. Although the Real Estate Regulatory Agency (RERA) in Dubai has enhanced responsibility on the part of the developers, there are still delays in deliveries caused by construction issues or market changes.

2. No Immediate ROI

Since off-plan properties are still under development, investors cannot generate rental income immediately. The ROI kicks in only after handover, which could take anywhere from 2 to 5 years, depending on the project.

3. Limited Scope for Due Diligence

Investors rely heavily on project brochures, virtual tours, and developer promises, often without seeing the physical unit. This creates a trust-based investment, where due diligence must be thorough regarding the developer’s track record and RERA approvals.

The Pros of Ready Properties

1. Instant Possession and Income

The most obvious advantage of ready properties is the speed of the transaction. Visitors can live in the place immediately and get rental income, so it is suitable for short-term investment.

2. See What You Buy

In ready properties, an investor gets the opportunity to inspect the unit in reality, the construction quality, the facility, and the environment. This personal experience helps a person to make a more competent choice and reduce the probability of regret.

3. Availability of Historical Data

Ready properties usually come with a history of rental yields, occupancy rates, and resale performance that can be studied before making the decision to buy. This method, based on the data, can secure a far more accurate ROI potential valuation.

4. Easier Financing and Resale

Banks are more likely to prefer ready properties for mortgage approvals, and it is generally faster to sell them on. In the case of flippers or early exits, those who opt for finished units will benefit from the enhanced liquidity and market response they enjoy.

The Cons of Ready Properties

1. Higher Upfront Costs

Finished properties are usually purchased at market price, and sometimes, their cost can be higher, especially for the best locations like Downtown Dubai or Palm Jumeirah. The buyer should pay a significant part of the price at the beginning; the money includes the total value of the property, the DLD registration, service fees, and broker charges.

2. Limited Flexibility in Design

Sometimes, when the property is already renovated, the investor has very little chance of the layout changes or does not change it at all due to the fact that the new property was already finished.

3. Older Infrastructure

The energy efficiency, smart home integration, and stylish design aesthetics are some of the things that would potentially lack in a few old, ready-to-use units, for example, those constructed before 2015.

Dubai’s Current Market Trends (2025 Perspective)

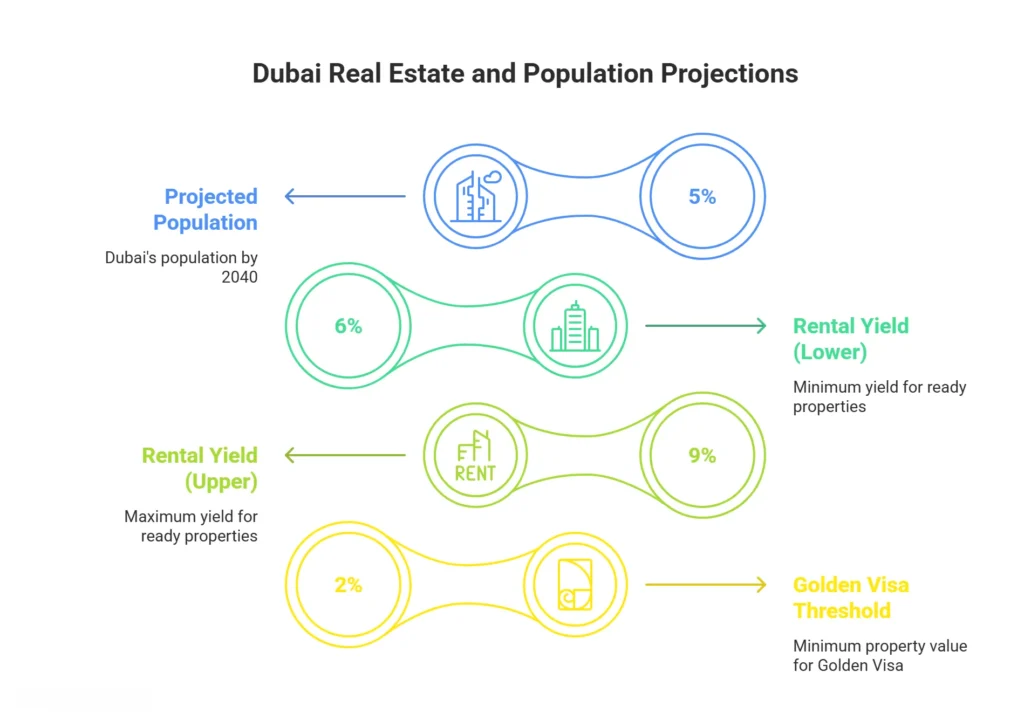

In the May Editorial of ours, Dubai was talked about to be a community with a population of around 5 million by 2040. The influx of people into the place is, in turn, what’s causing the surging demand for rentals in the well-connected communities.

Additionally, builders in Dubai are throwing in very good offers for off-plan properties in the peripheries such as Dubailand, Al Furjan, and the Dubai South region, which are planned for better accessible public transport services and economic proximity to Expo City. At the same time, already-completed properties in places like Business Bay, JVC, and Dubai Marina are giving high yields in the range of 6% and 9%, which depends on the unit type and the location.

With the rules for the Golden Visa allowing property value as low as AED 2 million, many investors decide to buy off-plan properties in bulk or choose premium ready apartments to be eligible for this visa. With the increase in demand in the market for both types of residences, it is more difficult to be decisive in the choice of purchase.

Conclusion: A Wise Choice for Investment Selection in 2025

The Dubai real estate sector is still rich in potential during the year 2025. If you are interested in purchasing off-plan property to make sure that it will retain or increase its value in the future, or in acquiring a ready property due to a more secure and instant profit option then both methods are drastically possible for you to receive a full level of income from investing with the discerning investors.

An investment in a project that has not yet been completed is a viable option if one wishes to grow the capital for the long term, especially in new areas with forthcoming infrastructure. However, the people willing to receive a return quickly by liquidating a property of value for a short time could be the people to whom the ready properties are appealing.

As always, the golden rule for success is to link the real estate property you opt for to your financial plan, and the investment horizon is going to rule your game of making and amassing wealth, the better for you and the future.