In Dubai’s competitive property market, service charges represent a significant ongoing expense that directly impacts both rental yields and personal budgets. Often glossed over amid discussions of purchase prices and financing, these fees cover the operation, maintenance, and management of all communal facilities—from lobbies and elevators to gardens and security systems. With the Dubai Land Department (DLD) forecasting average increases of up to 10 % in 2025, a clear grasp of how service charges are structured, calculated, and regulated is essential for anyone looking to invest, let a property, or simply manage household finances in the Emirate. This guide decodes every facet—definitions, breakdowns, official oversight, budgeting strategies, and the latest industry outlook—to empower you to plan effectively and safeguard your returns.

What Does “Service Charge” Mean in Dubai?

In straightforward terms, a service charge in Dubai refers to the periodic payments levied on property owners for the upkeep of shared and communal areas within a residential, commercial, or mixed-use development. Whether you own an apartment in a high-rise tower, a villa in a gated community, or office space in a multi-purpose complex, these fees ensure that common corridors, amenities, and infrastructure remain in good working order.

Dubai Properties Service Charges Are:

- Mandatory: Enforced by RERA (the Real Estate Regulatory Agency) under Law No. 6 of 2019 on Jointly Owned Properties.

- Recurring: Typically billed quarterly or annually, though some communities offer monthly payment options.

- Essential: Funding everything from routine cleaning to long-term capital reserves (the “sinking fund”).

Failing to pay can lead to late-payment penalties and, in extreme cases, legal action to recover outstanding dues.

What’s Covered by Dubai Properties Service Charges?

While specific inclusions vary by development, most Dubai service charges encompass:

- Structural Maintenance & Repairs

- Refurbishing and repainting exteriors and communal interiors

- Elevator, escalator, and façade upkeep

- Security Services

- CCTV monitoring, access-control systems, and patrol personnel

- Cleaning & Waste Management

- Common-area cleaning, waste removal, and sewage-system maintenance

- Landscaping & Outdoor Areas

- Lawn care, planting, irrigation systems, and pathway repairs

- Utilities for Shared Spaces

- Electricity, water, and, where applicable, district cooling or AC for lobbies, gyms, and pool areas (Banke International Properties)

- Administrative & Financial Overheads

- OA (Owners Association) management company fees, accounting, billing, insurance for communal assets

- Sinking Fund Contributions

- A mandated reserve for major future works—think roof replacement, external cladding upgrades, or elevator overhauls

Developments within master-planned communities (e.g., Dubai Marina, Dubai Hills) often add a master community fee to cover shared infrastructure like parks, roads, and community security.

How Are Dubai Properties Service Charges Calculated?

Dubai predominantly uses a per-square-foot (psf) model, multiplying the approved rate by your unit’s “chargeable area,” which can include:

- Internal floor space

- A share of common-area square footage (for apartments)

- Balconies or terraces (where specified)

- Plot or built-up area for villas (DrivenProperties)

Calculation Example

If your apartment is 400 sq.ft. and the approved rate is AED 10 psf, then:

Service Charge = 400 sq.ft. × AED 10 = AED 4,000 per billing period

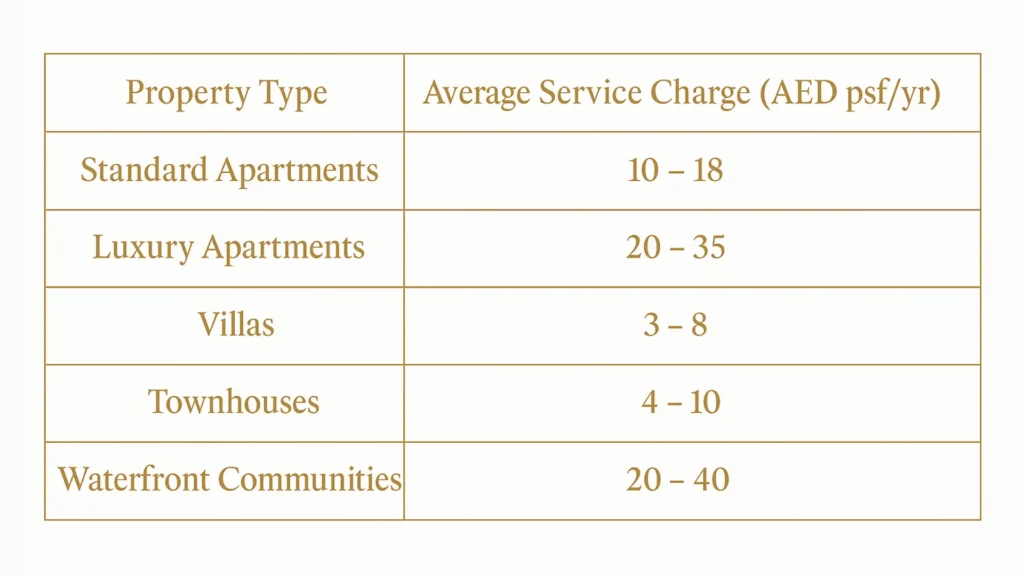

Average 2025 Rates by Property Type

Community Examples (2025)

Business Bay, Dubai Marina, JLT: AED 15 psf

The Greens & Palm Jumeirah: AED 13 psf

Dubai Sports City & Jumeirah Village Circle: AED 10 psf

Rates can range more broadly—from as low as AED 3 psf in some budget developments to over AED 30 psf in iconic towers like the Burj Khalifa—driven by amenity levels, building age, and OA management efficiency.

Official Oversight & Transparency

RERA & the DLD Service Charge Index

- Regulatory Authority: RERA (Real Estate Regulatory Agency), under the Dubai Land Department, reviews and approves all annual OA budgets and service charge rates.(Dubai Real Estate)

- Mollak Platform: Launched in 2019, Mollak is a central e-system where management companies submit budgets, owners pay into escrowed project accounts, and financial reports are audited. Over 1,240 buildings and 89 management firms now use Mollak, processing nearly AED 4 billion in charges annually. (ae)

- Service Charge Index (SCI): Available on the DLD website, the SCI lets you benchmark your building’s approved rates against similar properties across Dubai.

Budget Approval & Owner Rights

- OA budgets must be vetted and signed off by RERA before charges can be levied.

- Owners have the right to access detailed breakdowns via Mollak and to lodge formal complaints with RERA or the Rental Disputes Settlement Centre if discrepancies arise.

Rights & Responsibilities of Property Owners

- Payment Timeliness: Avoid penalties by honoring billing cycles—typically quarterly or annually.

- Invoice Scrutiny: Match invoices to RERA-approved budgets and query any variances immediately with your OA manager.

- Active Engagement: Attend OA meetings (or join the Owners Committee) to review budgets, advocate efficiency measures, and ensure value delivery.

- Dispute Resolution: If you believe charges are unjustified, file a complaint through Mollak or at the Rental Disputes Settlement Centre.

The 2025 Outlook: What to Expect

Industry forecasts point to a 5 – 10 % increase in average service charges for 2025, driven by:

- Inflation & Rising Utility Costs: DEWA tariffs and district cooling fees are climbing.

- Aging Infrastructure: Older buildings require more frequent, costly maintenance.

- Sustainability Compliance: Green building mandates and energy-efficiency upgrades add capital costs.

- Premium Management Demand: Upscale communities invest in high-end amenities and concierge services. (What’s On)

Counterintuitively, some facilities-management components have seen localized cost reductions due to competitive tendering—yet other segments (insurance, sinking fund contributions) continue to trend upward. Staying updated via Mollak and the DLD SCI is critical to anticipate changes before your next billing cycle.

Factoring Service Charges into Your Investment Returns

Gross vs. Net Yield

- Gross Yield: (Annual Rent ÷ Purchase Price) × 100

- Net Yield: ((Annual Rent – Service Charges – Other Expenses) ÷ Total Investment Cost) × 100

Since service charges often consume 10 – 25 % of gross rental income—especially in mid-market properties—net yields can fall well below headline figures. Always run a scenario analysis with base, high-charge, and low-charge cases to set a “service charge ceiling” that aligns with your required ROI.

Budgeting for Service Charges

- Obtain Verified Rates: Use Mollak or the DLD SCI to confirm the RERA-approved psf rate and your chargeable area.

- Build a Buffer: Plan for a 10 – 15 % contingency over the confirmed rate to cover unforeseen increases.

- Account for Chiller Fees: If not included in the main service charge, budget separately for cooling costs.

- Monitor Sinking Fund Health: Low contributions today can signal future special levies if capital reserves run dry.

- Reserve Funds for Voids: Landlords should maintain a personal reserve to cover service charges during tenant vacancies or delayed rent payments.

Effective Budgeting Tips

- Automate Reminders: Set calendar alerts ahead of quarterly/annual due dates.

- Use a Dedicated Spreadsheet: Track all property-related inflows and outflows, including service charges, DEWA bills, and management fees.

- Leverage Financial Apps: General budgeting tools or bank-provided apps can help maintain visibility on upcoming charges.

- Engage with Neighbors: Collective advocacy for energy-saving upgrades (LED lighting, motion sensors) can reduce common-area utility consumption and, over time, service charge components.

Disclaimer

This article compiles information accurate as of May 2025, sourced from the Dubai Land Department’s Service Charge Index, RERA’s Mollak system, and industry reports. Service charge allocations, rates, and regulations are subject to change. Readers are strongly advised to verify the latest figures and legal requirements via official channels—RERA Mollak (mollak.dubailand.gov.ae) and the DLD Service Charge Index (dubailand.gov.ae)—before making investment or budgeting decisions.